Invest for the Future

Plan Ahead – Depending on the Lottery Might Not Work

Plan Ahead – Depending on the Lottery Might Not Work

Investing for a dignified retirement, saving for college for the kids or other goals are not impossible dreams. But you do need a plan and you need to follow it systematically to achieve your goals. A Primerica representative can help you get started right now. The sooner you start the better – put time on your side.

You Can Control Your Future

There are no guarantees but, to a great extent, you can control the quality of life you and your family will enjoy years from now. Whether it is saving and investing for retirement, school or both, these are goals that are still achievable but they will require commitment to a financial game plan over decades. Primerica can help you get started today. The sooner you start the better.

The Concept and Funding of Retirement Has Changed

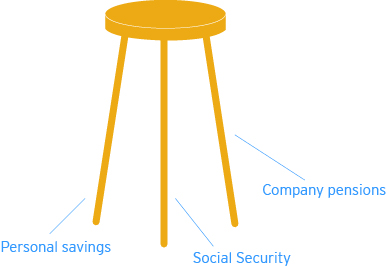

For many decades, financial experts have compared a secure retirement to a three-legged stool. Three sources of income supported a good retirement.

- Company pensions

- Social Security

- Personal savings

The three legs could often supply an ample and steady income during retirement. But, today, company pensions have just about gone the way of the Dodo bird. And if nothing is done to shore up its finances, Social Security will be forced to pay out benefits at much-reduced rates to seniors and others who depend on the program sometime around 2033. (Status of the Social Security and Medicare Programs: A Summary of the 2013 Annual Reports, ssa.gov.)

People could work until they reached 65 and then depend upon their pensions, Social Security and personal savings to provide a stable income. But, today, company pensions have just about gone the way of the Dodo bird. If nothing is done to shore up its finances, Social Security’s “trust fund” will run out by 2033 – leaving the program to pay out benefits at a much reduced rates to seniors and others who depend on the program. (ssa.gov, Status of the Social Security and Medicare Programs: A Summary of the 2013 Annual Reports)

What Does This Mean for You?

Because retirement resources are shrinking, it’s really up to you to build retirement savings that you can count on. Primerica can help you get started for as little as $50 per month. Sit down with your securities-licensed Primerica representative to learn the basics of investing — it’s never too late to get started — and plot your course to financial security in retirement!

The Three Accounts You Need

To build a complete savings program, Primerica believes most people need three types of basic accounts:

- Emergency Fund — for unexpected emergencies

- Short-Term Savings — for big-ticket items like vacations or a computer

- Long-Term Savings — for your retirement, college for the kids, etc.

Put Your Savings on Autopilot

If you're not as disciplined as you want to be, try direct deposit. The temptation to spend can be irresistible ... so why not take the money out of your wallet before you can spend it? Primerica makes it easy to help you arrange to have a set amount of your paycheck deposited directly into your savings or investment account.* Ask your Primerica representative for more information about direct deposit.

The High Cost of Waiting

The biggest mistake you can make is assuming you don't have any money to save. If you earn an income, it's simply a matter of how you're spending it. You can put some money aside each month — if you make saving for your future a priority. The longer you wait the more money you will need to save each month to make up for lost time.

Don't Make This Mistake

| Invest $100/month at 9% until age 67 | ||

| Begin saving at | Total at 67 | Cost to Wait |

| Age 25 | $566,920 | |

| Age 26 | $517,150 | $49,770 |

| Age 30 | $357,240 | $209,680 |

| Age 40 | $137,780 | $429,140 |